Unlocking Value: How Section 45V of the Inflation Reduction Act Could Revolutionize US Coal Markets

Key Ideas

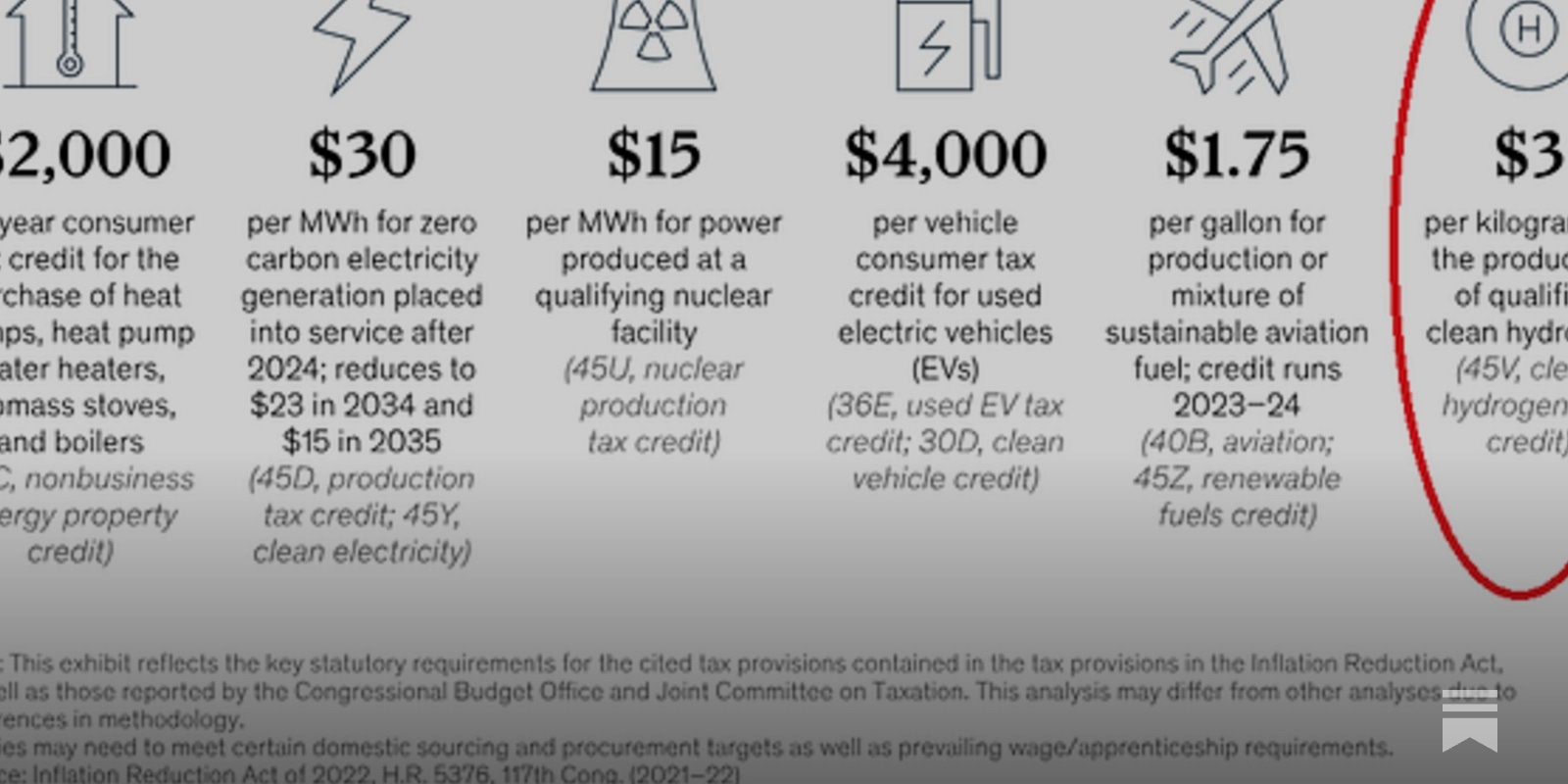

- The Inflation Reduction Act of 2022, particularly Section 45V, introduces clean hydrogen tax credits that could significantly benefit some US coal mines by creating a new revenue stream from coal mine methane (CMM) sales.

- While wind and solar tax credits have been extended, the focus on carbon capture and storage projects under the IRA may take time to materialize, indicating a gradual transition towards cleaner energy sources.

- The provision in Section 45V incentivizes hydrogen production using sources like CMM, known for their negative carbon intensity, which aligns with the goal of rewarding low-carbon initiatives and reducing overall GHG emissions.

- The interpretation of 45V by the US Treasury Department sheds light on how hydrogen producers can leverage sources like CMM to maximize tax credits, potentially revolutionizing the energy landscape and creating new investment opportunities.

The Biden Administration's Inflation Reduction Act of 2022, while not directly impacting US coal markets in a significant way, contains a promising provision in Section 45V that focuses on clean hydrogen tax credits. This provision has the potential to bring about a transformative shift in the energy sector, particularly for some US coal mines. By incentivizing hydrogen production with sources like coal mine methane (CMM) that possess a negative carbon intensity, Section 45V aims to promote low-carbon initiatives and mitigate greenhouse gas emissions. The tax credits provided under 45V could open up new revenue streams for coal mines and contribute to the overall effort in promoting cleaner energy practices. Although the act extended tax credits for wind and solar energy, the emphasis on carbon capture and storage projects signals a gradual move towards sustainable energy sources. Through the utilization of CMM in hydrogen production, businesses can tap into significant financial incentives and position themselves as leaders in the low-carbon energy landscape. The recent interpretation of 45V by the US Treasury Department clarifies the mechanisms through which hydrogen producers can capitalize on sources like CMM to maximize tax benefits, paving the way for innovative investment opportunities and potentially reshaping the dynamics of the energy market.

Topics

Blue Hydrogen

Legislation

Carbon Capture

Investment Opportunities

Energy Markets

Tax Credits

Coal Industry

Latest News