Navigating the Hydrogen Investment Landscape: A Comprehensive Guide for 2025

Key Ideas

- The global hydrogen market is set to reach $500 billion by 2025, signaling rapid growth and attracting investments from major corporations and governments globally.

- Key drivers such as decarbonization goals, technological advancements, and government support are shaping the hydrogen economy's expansion.

- Blue hydrogen offers immediate investment potential with lower costs, while green hydrogen presents long-term growth opportunities with projected cost reductions.

- Investors need to assess risk factors specific to blue and green hydrogen types, considering factors like regulatory uncertainties and supply chain risks.

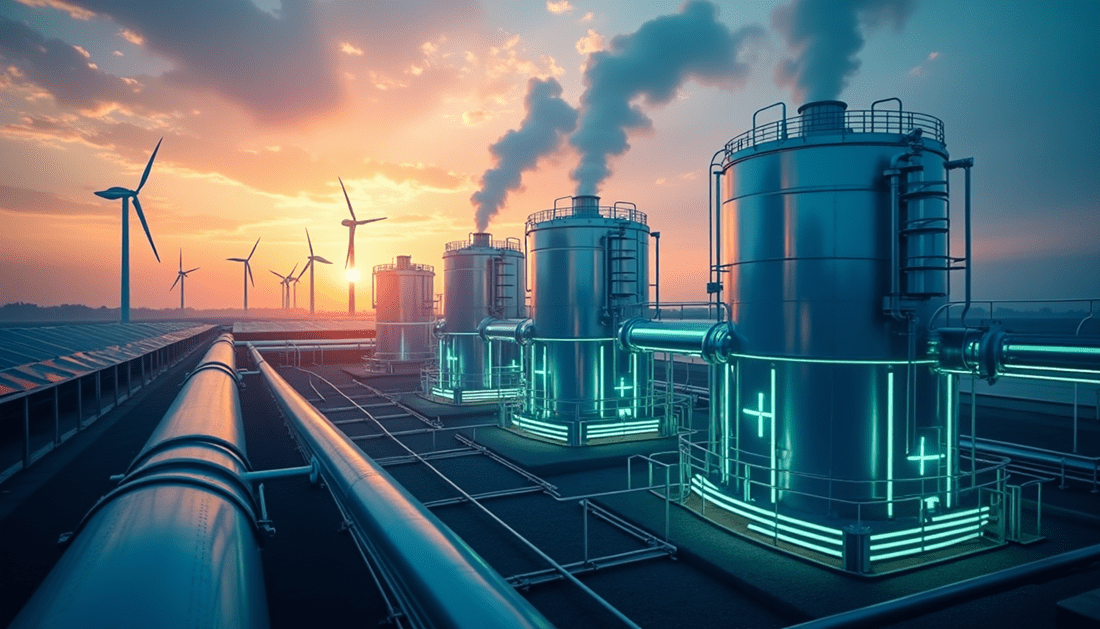

The hydrogen market is rapidly expanding, with projections indicating substantial growth potential, reaching $500 billion by 2025. This surge in interest is driven by key factors such as decarbonization goals, advancing technologies, and government backing. The market landscape reveals diverse regional opportunities, with Asia-Pacific emerging as a fast-growing region and North America maintaining dominance. Notably, China plays a significant role with its majority share in global manufacturing capacity. Challenges persist, with the United States facing hurdles in green hydrogen projects while Europe showcases robust policy support. The distinction between blue and green hydrogen is crucial for investors, with blue offering immediate returns and green promising long-term growth. Various cost and profitability analyses highlight the financial outlook for each hydrogen type, along with associated risks and mitigation strategies. Investors exploring strategic options can consider direct company investments, stocks, and diverse project opportunities in the expanding hydrogen market.

Topics

Investing

Blue Hydrogen

Green Hydrogen

Energy Transition

Technological Advancements

Market Projections

Investment Strategies

Clean Energy Initiatives

Regional Opportunities

Latest News