HDF Energy Strengthens Market Position with Share Repurchase Strategy

Key Ideas

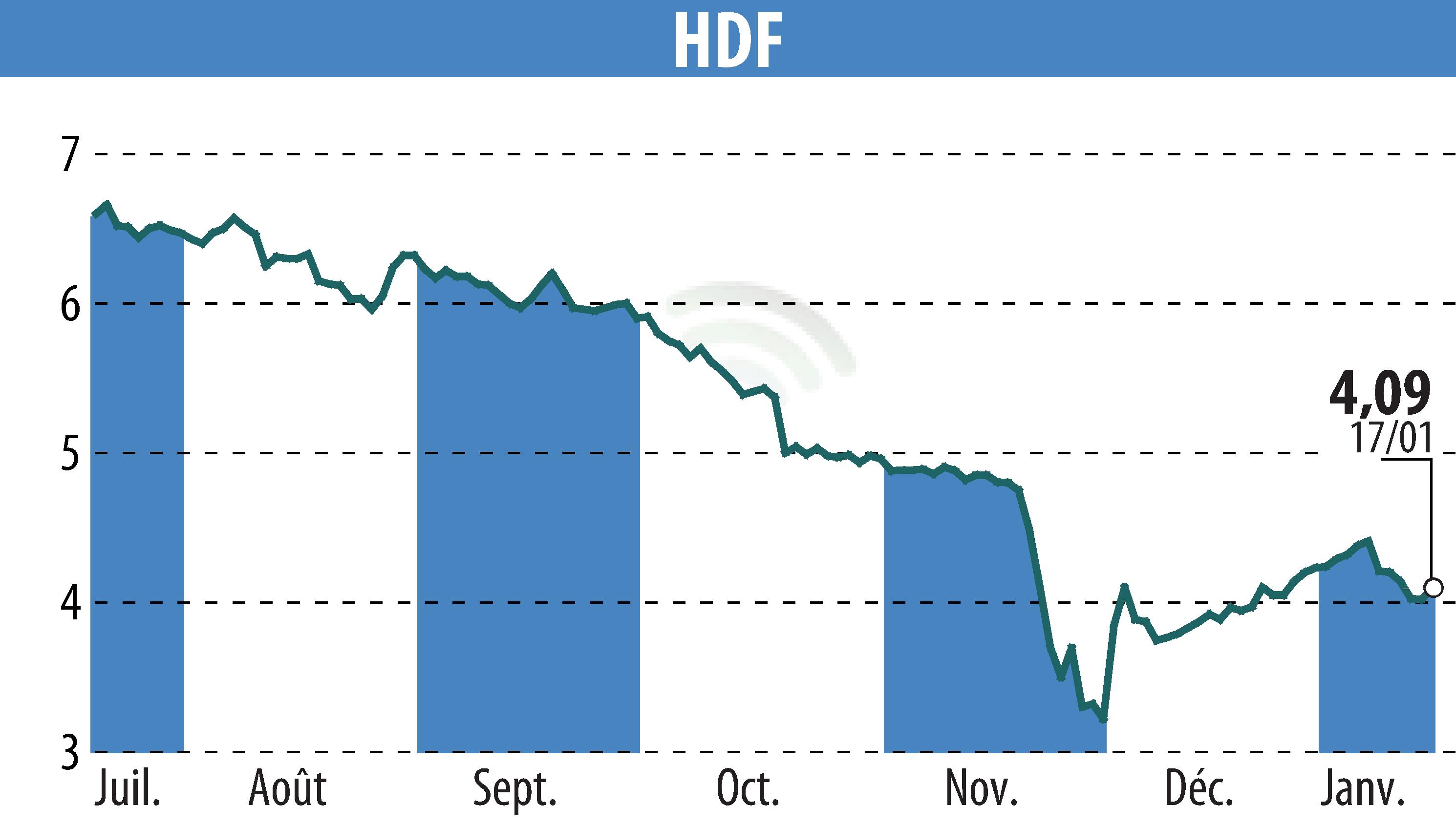

- HDF Energy recently repurchased 29,371 of its own shares on Euronext stock exchange between 13 and 17 January 2025.

- The average weighted price of the acquired shares ranged between 4.05 and 4.20 euros, part of the company's equity optimization strategy.

- The share acquisition is a key move in HDF Energy's growth and sustainable development strategy, focusing on hydrogen infrastructure and fuel cells.

- This action highlights HDF Energy's commitment to strengthening its market position as a global player in the hydrogen sector.

HDF Energy, a prominent player in the hydrogen sector, announced its recent share repurchase transactions on 20 January 2025. The company repurchased a total of 29,371 shares on the Euronext stock exchange between 13 and 17 January 2025, with the average weighted price of shares acquired ranging between 4.05 and 4.20 euros. These transactions were conducted under the Market Abuse Regulation (MAR) and are part of HDF Energy's strategy to optimize its equity management. The share repurchase is a crucial step in HDF Energy's growth and sustainable development strategy, particularly focusing on hydrogen infrastructure and fuel cells. By strengthening its market position through this share acquisition, HDF Energy reinforces its status as a global player in the hydrogen sector, emphasizing its commitment to advancing hydrogen technologies.