Pennsylvania Governor Proposes Tax Breaks for Energy Projects and Hydrogen Production

Key Ideas

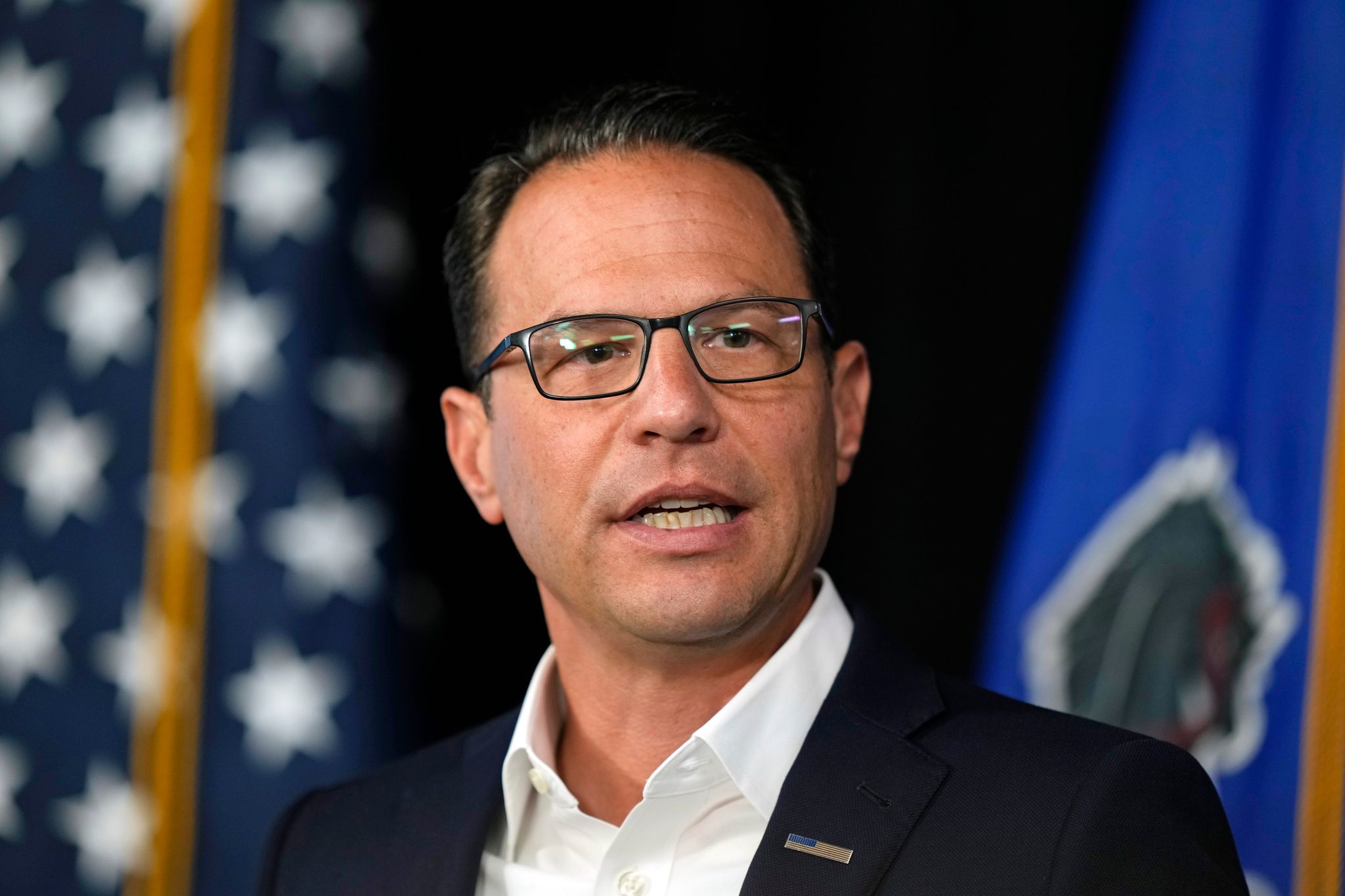

- Governor Josh Shapiro is aiming to fast-track energy projects and offer tax breaks to incentivize electricity production and hydrogen projects, positioning Pennsylvania to be more competitive.

- Proposed tax credits could reach up to $100 million per year for power plants, $49 million for hydrogen producers, and $15 million for sustainable aviation fuel producers.

- Shapiro's plan involves creating a new board to streamline permitting for energy projects, emphasizing the need for immediate action to meet energy demands and attract investments.

- The focus on hydrogen production aligns with efforts to transition away from fossil fuels and combat climate change, with potential benefits for economic growth and environmental sustainability.

Governor Josh Shapiro of Pennsylvania has announced plans to accelerate major energy projects in the state and introduce significant tax incentives for endeavors that contribute to the electricity grid and produce hydrogen. With the backdrop of an impending energy crisis that could increase electricity costs, Shapiro aims to bolster Pennsylvania's energy landscape and attract large-scale ventures like data centers and electric vehicle factories. His proposal includes the establishment of the Pennsylvania Reliable Energy Siting and Electric Transition Board to facilitate the approval process for new energy initiatives. The tax credits under consideration could amount to substantial sums, with power plants, hydrogen producers, and sustainable aviation fuel projects being eligible for financial support.

Shapiro's proactive approach signals a commitment to positioning Pennsylvania as a competitive player in the energy sector, aligning with broader efforts to enhance the state's economic prospects and sustainability practices. By focusing on fast-tracking project approvals and offering financial incentives, the governor aims to address immediate energy needs while fostering long-term growth and innovation. Notably, the emphasis on hydrogen production underscores a strategic shift towards cleaner energy sources and technological advancements.

The proposed tax breaks and streamlined permitting processes reflect Shapiro's vision for Pennsylvania to lead in energy innovation and attract investments, particularly in the burgeoning hydrogen sector. By championing these initiatives, Shapiro seeks to propel the state forward in energy transition efforts and ensure it remains a desirable destination for cutting-edge energy projects. Embracing renewable energy sources and promoting sustainable practices are key components of the proposed strategy, emphasizing the dual goals of economic development and environmental stewardship.

As Pennsylvania navigates the evolving energy landscape and contends with increasing energy demands, Shapiro's proactive stance on energy policy could pave the way for a more robust and resilient energy infrastructure. The focus on hydrogen production not only signals a commitment to reducing carbon emissions but also opens up new opportunities for technological advancement and economic growth. By engaging with stakeholders and advocating for supportive measures, Shapiro aims to position Pennsylvania as a trailblazer in energy sustainability and innovation.

Topics

Aviation

Renewable Energy

Climate Change

Economic Development

Legislation

Electricity Grid

Energy Projects

Pennsylvania

Tax Breaks

Latest News