Accelerating CCS Deployment in the EU through the European CCS Bank

Key Ideas

- IOGP Europe calls for the establishment of a European CCS Bank to accelerate CCS project deployment in the EU by 2025.

- The European CCS Bank aims to bridge the cost gap for CCS investments, making capture projects financially viable and driving industry decarbonization.

- Carbon Contracts for Difference (CCfDs) offer stable and predictable environments for investors, ensuring economic viability and enabling new CCS projects.

- The European CCS Bank will deploy a competitive auctioning mechanism under the Innovation Fund to support CCS projects and maximize greenhouse gas emissions reduction.

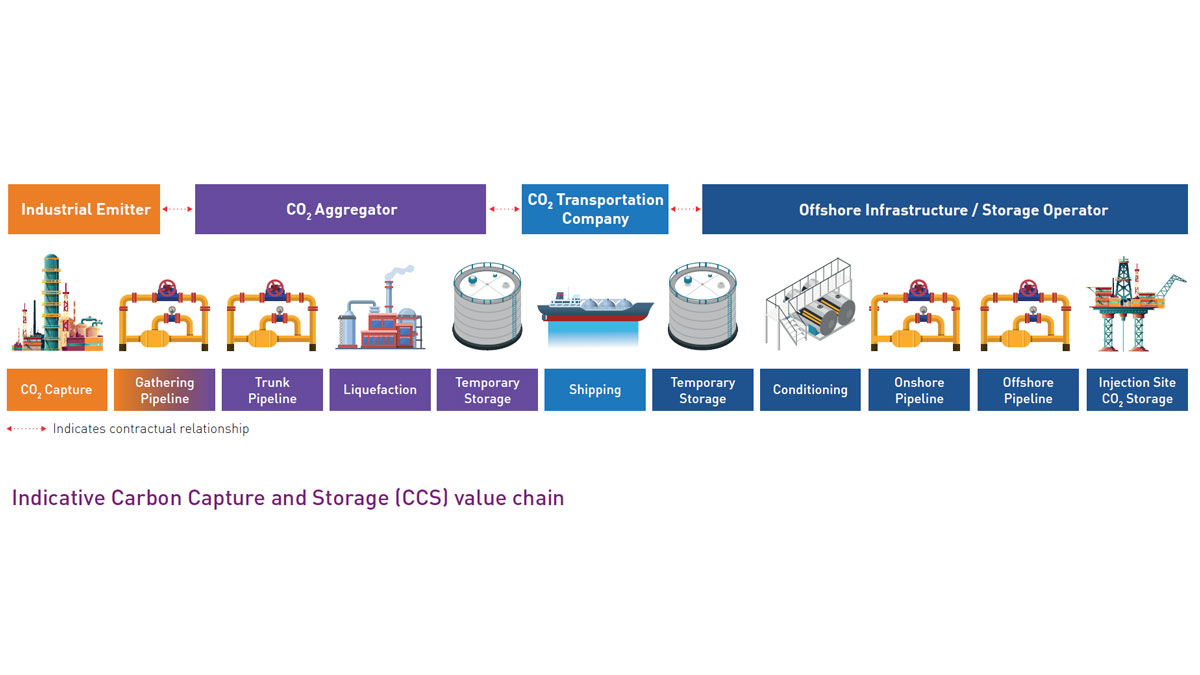

To accelerate Carbon Capture and Storage (CCS) project deployment in the EU, the International Association of Oil & Gas Producers Europe (IOGP Europe) advocates for the establishment of a "European CCS Bank" by 2025. Despite CCS being recognized as crucial for industrial decarbonization, slow project deployment persists due to cost disparities between CO2 capture and carbon allowance prices under the EU Emissions Trading System (ETS). The proposed bank, through a Carbon Contracts for Difference (CCfD) auctioning mechanism, aims to address this gap and provide financial incentives for CCS investments. The European CCS Bank offers benefits such as cost-efficiency rewards, reduced project risk, price discovery, and market formation. By closing the financial disparity, it seeks to accelerate CCS deployment and facilitate industry decarbonization while preserving competitiveness. The role of CCfDs is crucial in incentivizing companies to invest in CCS technologies. CCfDs bridge the cost gap between stable price levels and volatile ETS allowance prices, ensuring the economic viability of capture investments. National schemes like the one in the Netherlands have been successful, providing stability for investors and enabling new projects. European CCfDs are proposed to be integrated with other financing instruments to support industries with varying decarbonization challenges. The European CCS Bank will operate under a competitive auctioning scheme, similar to the Hydrogen Bank, supporting CCS projects and maximizing greenhouse gas emissions reduction. Through transparent and efficient bidding, the bank aims to allocate funds cost-effectively, de-risk projects, and leverage private capital efficiently. Overall, the European CCS Bank intends to play a pivotal role in accelerating CCS deployment and driving industry decarbonization in the EU.