ArcelorMittal's Strategic Move: Investing in Vallourec for Hydrogen Storage

Key Ideas

- ArcelorMittal acquires shares of Vallourec, focusing on hydrogen storage solutions, as part of decarbonizing steel production.

- Positive market response to Vallourec's Delphy activity, with €2 billion worth of potential projects in the pipeline.

- Strategic move for both companies as Vallourec's new energy activities aim to contribute significantly to group turnover by 2030.

- ArcelorMittal's interest in Vallourec strengthens due to the potential in Middle East markets and future hydrogen storage needs.

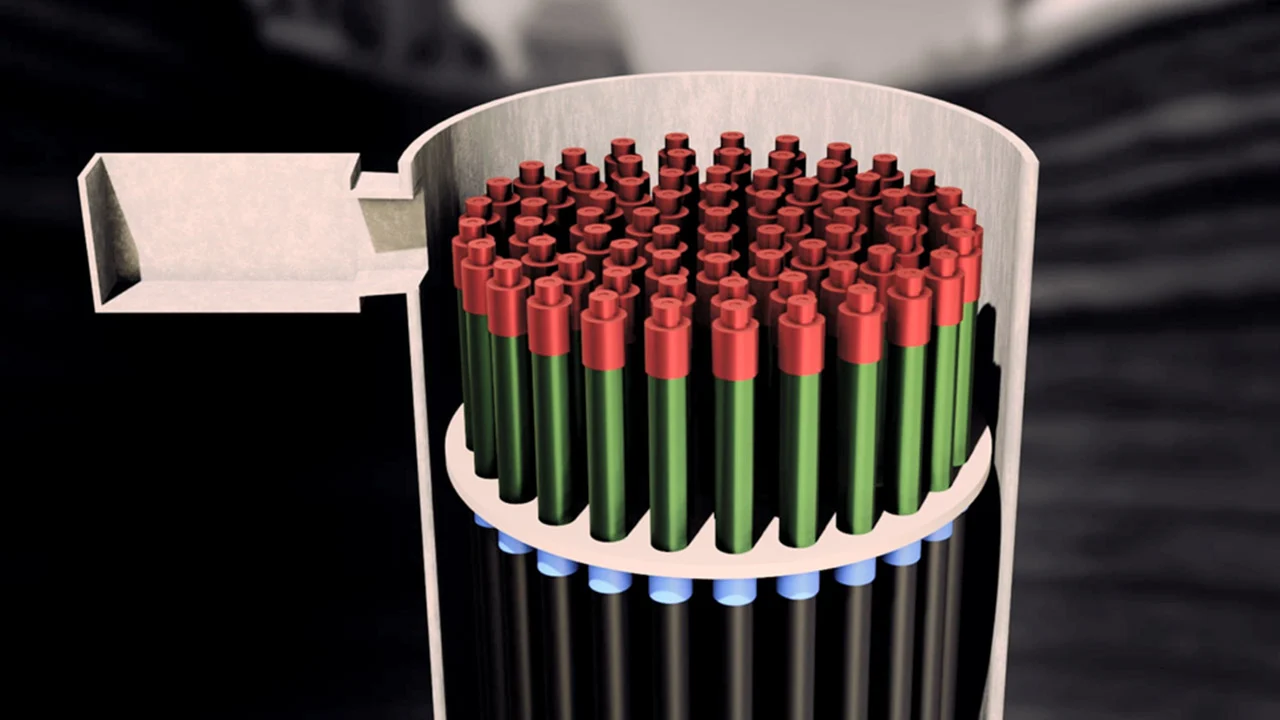

ArcelorMittal has acquired shares of Vallourec previously held by the Apollo fund, signaling a strategic move towards hydrogen storage solutions. The $955 million acquisition solidifies ArcelorMittal's interest in decarbonizing steel production through innovative technologies. Vallourec's Delphy activity, focusing on hydrogen storage, has garnered positive market attention, with projections of €2 billion in upcoming projects. This aligns with ArcelorMittal's goal of transitioning to cleaner energy sources, making Vallourec an attractive investment partner. The partnership is also seen as beneficial for Vallourec, with the company restructuring its operations and financial structure with Apollo's assistance. With potential demand for Delphy solutions in the Middle East and a target of 10 to 15% of the group's turnover from new energy activities by 2030, both companies stand to benefit from this collaboration. While ArcelorMittal currently holds a 27.5% share in Vallourec, it has not announced plans for a public offer on remaining shares in the short term. The move showcases a positive sentiment towards hydrogen storage and the energy transition within the steel industry.

Topics

Projects

Investment

Energy Transition

Market Potential

Steel Industry

Strategic Partnership

Financial Recovery

Latest News