HDF Energy's Strategic Share Repurchase in the Hydrogen Sector

Key Ideas

- HDF Energy executed three share repurchase transactions on the Euronext market in accordance with market regulations.

- Shares were repurchased on different dates at varying prices, indicating a strategic financial move by HDF Energy.

- The transactions are part of HDF Energy's financial strategy as a key player in the hydrogen sector, specializing in fuel cells.

- HDF Energy aims to contribute to the decarbonization of the energy and heavy mobility sectors through its operations.

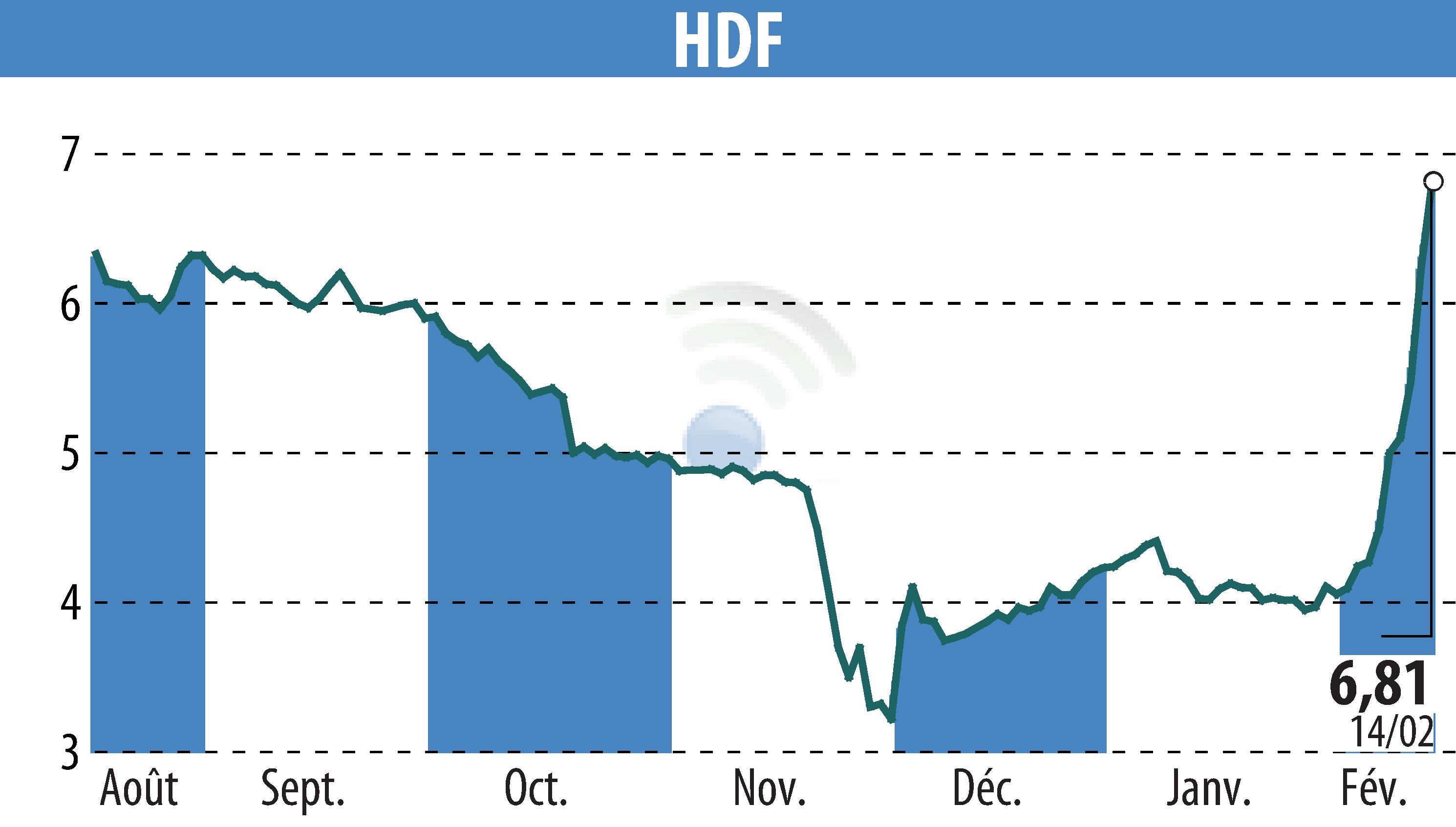

On February 17, 2025, HDF Energy disclosed details of its share repurchase transactions in compliance with the Market Abuse Regulation. The company repurchased 152 shares on February 12 at €5.18 per share, followed by 1,938 shares on February 13 at €5.96 each, and 2,148 shares on February 14 at €6.76 per share. These strategic transactions on the Euronext market showcase HDF Energy's financial planning. Being a prominent player in the hydrogen sector with expertise in fuel cells, HDF Energy aims to play a significant role in the decarbonization of energy and heavy mobility industries. The share repurchases align with the company's commitment to sustainable practices and support for green technologies. The deliberate investment in its own shares reflects confidence in its future growth and underscores its strategic approach to financial management within the renewable energy landscape.